Bell to gobble up Astral Media

Cross-posted from Mediamorphis Sometimes I just wish I could wake up in the morning and not be thrust into the hurly-burly of all the stuff roiling the telecom-media-Internet industries in Canada. But no! If it ain’t copyright maximalists trying to lock up content (Bill C-11) or spooks trying to stuff the telecom-Internet infrastructure with new surveillance gear (Bill C-30), it’s big TMI conglomerates like Bell swallowing up erstwhile competitors like Astral. Now, this is not just a little deal, but a massive deal between Bell/CTV, the largest TMI conglomerate in the country with revenues of just over $22 billion, and Astral, the eighth largest media outlet in Canada with revenues of $888.1 million in 2010. While Astral is the fifth largest television operator (after Bell/CTV, Shaw/Global, Quebecor/TVA, CBC, in that order) and second largest radio station owner (after the CBC) in Canada, it is but a pygmy alongside Bell. If this deal goes through, we will have lost yet another independent and our position as having one of the most concentrated set of TMI industries amongst the developed capitalist economies will be yet further cemented (see here).

Bell has major and more often than not dominant stakes in the following TMI sectors (with ranking in each market indicated in parentheses): wired (1) and wireless telecoms services (3), internet access (1), tv distribution (cable, DTH, IPTV) (3), broadcast television (2), pay and specialty channels (2) and radio (5).

For it’s part, Astral is the fourth largest specialty pay television service provider in the country with 24 channels (e.g. the Movie Network/HBO Canada, Super Écran, Family, Disney Junior, Disney XD, Canal Vie, Canal D, VRAK.TV and TELETOON). It currently has just over 15 percent of the market. Astral is also the second largest radio station ownership group in the country, with 83 stations and 17.1% of the market.

All told, it is, as indicated above, the eighth largest media player on the media landscape in Canada (excluding wired and wireless telecoms services). Steve Faguy has a good break-down according to English and French language markets.

Astral has also been important because in a country where vertical integration has moved from the margins to the norm, it was one of the most significant non-integrated actors. Astral is to television and radio what Telus is to telecoms: a large, indeed, dominant player in its own right, but without clout across the mediascape as a whole and thus a source of some diversity within each of the media sectors they operate.

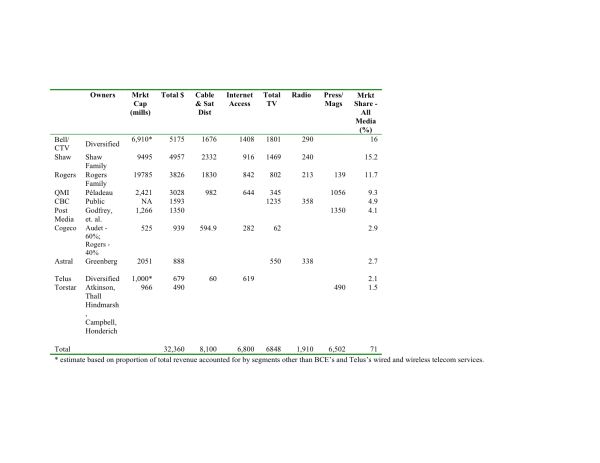

The figure below shows the “big 10″ media companies in Canada before this transaction.

Should this deal be permitted, Bell will end up with:

- 40% of the pay and specialty television market;

- a whopping 34.3% share of the entire Canadian television universe;

- and catapult from being the fifth ranked player in radio to top dog with over a quarter of all radio revenues;

- its dominance across the TMI industries as a whole will be further cemented, rising from roughly 16% of all revenues across the network media industries to just under a fifth of all revenues (excluding wired and wireless telecoms).

All said and done, if the Competition Bureau and CRTC approve the transaction, Bell will add 24 pay and specialty television services to the 29 it already owns (total 53 services) in addition to already owning the largest conventional television broadcaster, CTV, plus the second english-language network, CTV2 (the former A-channels). It will have 116 radio stations, whereas it currently has 33.

Instead of relying on the market as a way of acquiring and developing programming and content, Bell’s acquisition of Astral would simply absorb a significant part of the television and radio market into its sprawling hierarchy, in the hope that doing so will drive it’s efforts to drive more traffic over its broadband networks and thus feed its desire to have bandwidth, not content, serve as a key source of revenue.

As the famous economist Ronald Coase noted as far back as 1937, there are two ways of dealing with uncertainty and complex business environments: the market or hierarchies. The fact that “Astral products currently represent Bell’s largest single content cost”, as the news releaseannouncing the deal this morning notes and as Faguy observes, is probably one of the most important elements of the transaction. Indeed, it is. No longer needing to rely on the market, Bell’s acquisition puts an over-weighted thumb on the scales of hierarchies over markets.

Bell’s CEO, George Cope claims that “Anything that moves the pendulum away from regulation is a good thing for consumers, the concept of monopoly is . . . antiquated” is simply self-serving cant. Yet, it really is an open question as to whether or not regulators will turn back this deal.

I have my doubts mostly because the CRTC seems congenitally incapable of encountering a merger or take-over it can’t justify. The arguments are always the same: deep pockets are good for CanCon, Canada’s media economy is small relative to world standards, integration will give behemoths incentives to invest. All such claims are mostly bogus.

The CRTC’s 2008 Diversity of Voices decision set out some rules on the matter, but I’m afraid that they are too weak. That decision set out for major guidelines that would be used to evaluate mergers and acquisitions, but the most important one in the present case is Ownership Caps it set out. According to these new guidelines, any transaction that results in a single ownership group controlling less than 35% of the television broadcasting and pay and specialty market will be seen as not diminishing diversity and approved. Those that fall into the 35-45% range will be considered as potentially lessening competition and reviewed, while anything over 45% will be seen as creating excessive concentration and rejected.

Today’s deal falls in category two as potentially lessening competition and thus will no doubt be reviewed. However, the problem is that the adopted thresholds that were originally developed by the Competition Bureau for measuring competition in banking services and have nothing to do really with important values related to diversity of sources and content, freedom of expression, and so forth that are relevant to assessing communication and media matters.

The transaction will not cross the 45% threshold which triggers outright rejection, but in pay and specialty television services, the fact that Bell will have 40% of the market comes damn close. A more reasonable standard would see this rejected on its own merit. As I’ve said a million times before, we already have one of the most concentrated markets in the world and we are no better for it. This deal should be stopped in its tracks.

At the end of the day, and seen from the perspective of the media economy as a whole, this will also move levels of concentration amongst the “big four” (Bell, Shaw, Rogers, QMI) even higher.

Concentration levels among the big four for pay and specialty television services will move from roughly 84% to just under 90%. If we combine conventional broadcast tv with pay and specialty tv, the big four will go from controlling 77.5% of the market to 85.%. And if we take the big view and look across the entire network media economy, levels of concentration amongst the big 4 will rise from the already historic all-time high of 59 percent to about 68%. This is truly incredible.

Take action now!

Take action now!

Sign up to be in the loop

Sign up to be in the loop

Donate to support our work

Donate to support our work